🧭 Sample Settings

This page provides two example wallet configurations based on real, high-performing Polymarket traders.

These presets are designed to:

- Reduce decision fatigue for new users

- Demonstrate how Olympus risk controls work in practice

- Scale cleanly with larger balances

💰 Example Assumptions

All examples below assume:

- Starting balance: $10,000

- Max trade size: $500 (≈ 5% of balance)

- Bot behavior: Trades may consist of multiple fills or additional buys

- Max trades per market: 3

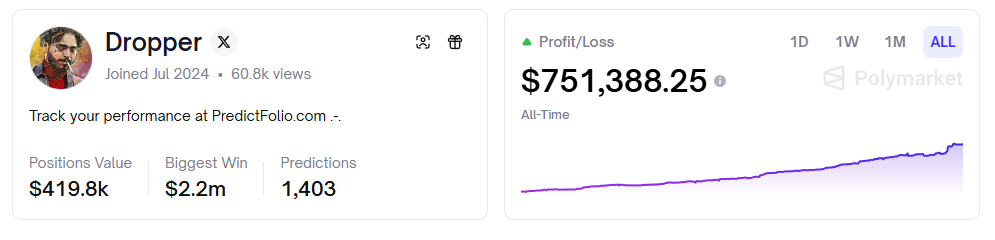

🧠 Wallet #1 — Dropper

Dropper on Polymarket

Dropper on Predicts.guru

High-Conviction Macro Trader

🔍 Wallet Overview

- Trading style: Macro, geopolitics, long-term narratives

- Trade behavior: Large, deliberate entries

- Holding period: Medium to long

- Variance: Low

📌 Why this matters

Dropper does not trade frequently, but when he does, the conviction is high.

Your goal is to participate safely, not match his absolute size.

⚙️ Recommended Settings — Dropper

Core Trade Controls

- Ratio:

0.5% - Maximum Trade Size:

$500 - Minimum Trigger Amount:

$1,000

Market & Risk Filters

- Max Open Markets:

10 - Max Total $ Size per Market:

$1,000 - Max Trades per Market:

3 - Skip Markets Expiring After:

30 days - Minimum Odds:

15% - Maximum Odds:

90%

Stop-Loss & Take-Profit

- Stop-Loss:

15% - Take-Profit:

25%

🧠 Risk Clarification (Important)

Even though the max trade size is $500, a single market may involve:

- An initial buy

- One or two additional buys (DCA or partial fills)

With Max Trades per Market = 3, your worst-case exposure to one market could be:

$500 × 3 = $1,500 (~15% of account)

This is intentional and controlled, and is why the max trades value matters.

✅ Best For

- Users who want stable, macro-driven exposure

- Longer-lived markets

- A strong “core” wallet

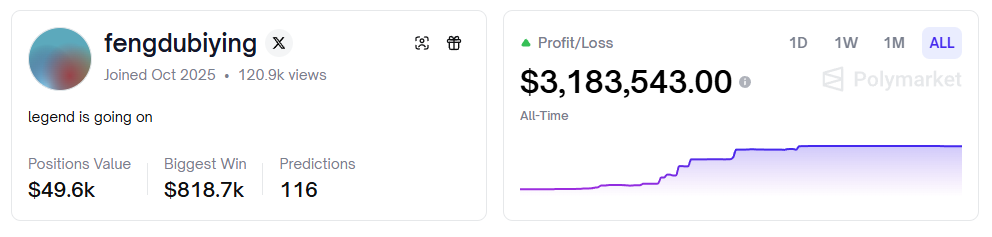

⚡ Wallet #2 — fengdubiying

fengdubiying on Polymarket

fengdubiying on Predicts.guru

High-Variance Sports & Event Specialist

🔍 Wallet Overview

- Trading style: Sports & esports (BO1 / BO5 events)

- Trade behavior: Very large, concentrated bets

- Holding period: Short

- Variance: High

📌 Why this matters

This wallet can be extremely profitable, but only when strict limits are in place.

Without caps, even one copied trade could dominate your portfolio.

⚙️ Recommended Settings — fengdubiying

Core Trade Controls

- Ratio:

0.15% - Maximum Trade Size:

$500 - Minimum Trigger Amount:

$3,000

Market & Risk Filters

- Max Open Markets:

7 - Max Total $ Size per Market:

$750 - Max Trades per Market:

3 - Skip Markets Expiring After:

14 days - Minimum Odds:

20% - Maximum Odds:

85%

Stop-Loss & Take-Profit

- Stop-Loss:

10% - Take-Profit:

20%

🧠 Risk Clarification (Important)

Just like above, a “trade” may consist of multiple buys.

With:

- $500 max trade size

- 3 trades per market

Your maximum exposure to one event is intentionally capped at:

$1,500 (~15% of account)

This keeps high-variance strategies survivable.

✅ Best For

- Users comfortable with volatility

- Short-term, fast-resolving markets

- A secondary wallet after you understand Olympus behavior

✅ Final Notes

- These are example presets, not guarantees

- Always start conservative and scale gradually

- Larger balances provide more flexibility, fewer skips, and better execution

- Olympus gives you tools — risk control is still your responsibility

When in doubt:

Lower ratios, keep caps, and let the edge compound.